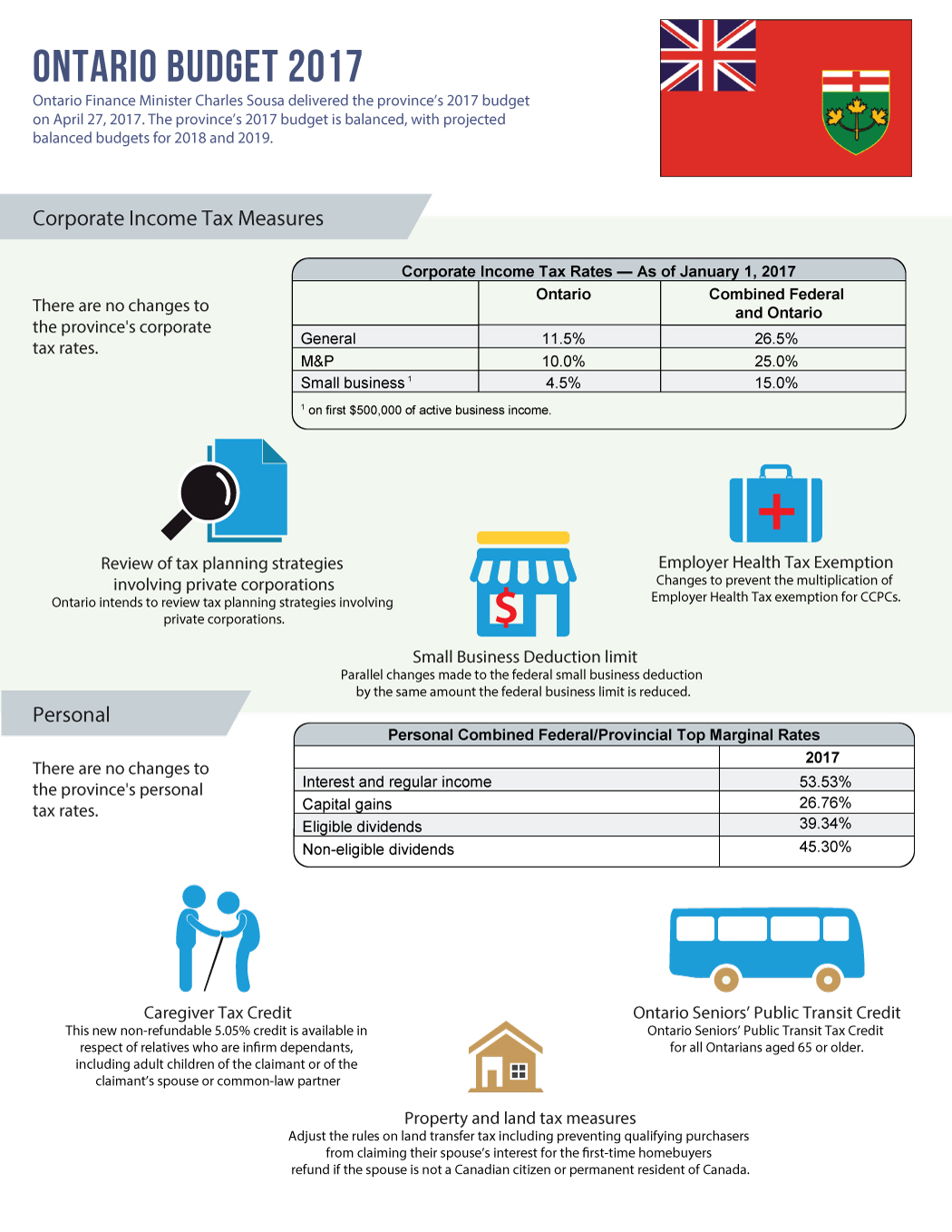

Ontario Budget 2017

Ontario Finance Minister Charles Sousa delivered the province’s 2017 budget on April 27, 2017. The province’s 2017 budget is balanced, with projected balanced budgets for 2018 and 2019.

Corporate Income Tax Measures

No changes to corporate taxes were announced.

| Corporate Income Tax Rates- As of January 1, 2017 | ||

| Ontario | Combined Federal & Ont | |

| General | 11.5% | 26.5% |

| M&P | 10.0% | 25.0% |

| Small Business* | 4.5% | 15.0% |

| *on first $500,000 of active business income | ||

- Review of tax planning strategies involving private corporations: Ontario intends to review tax planning strategies involving private corporations

- Income splitting with family members

- Passive investment portfolio inside a corporation

- Converting regular business income to capital gains

- Employer Health Tax Exemption: Changes to prevent the multiplication of Employer Health Tax exemption for CCPCs.

- Small Business Deduction limit: Parallel changes made to the federal small business deduction by the same amount the federal business limit is reduced

Personal Income Tax Measures

No changes to personal taxes were announced.

| Personal Combined Federal/Provincial Top Marginal Rates | |

| 2017 | |

| Interest and regular income | 53.53% |

| Capital gains | 26.76% |

| Eligible dividends | 39.34% |

| Non-eligible dividends | 45.30% |

- Caregiver Tax Credit: This new non-refundable 5.05% credit is available in respect of relatives who are infirm dependents, including adult children of the claimant or of the claimant’s spouse or common‐law partner

- Ontario Seniors’ Public Transit Credit: Ontario Seniors’ Public Transit Tax Credit for all Ontarians aged 65 or older.

- Property and land tax measures: Adjust the rules on land transfer tax including preventing qualifying purchasers from claiming their spouse’s interest for the first‐time homebuyers refund if the spouse is not a Canadian citizen or permanent resident of Canada.

Please don’t hesitate to contact us if you have any questions.