Life Insurance as an Investment for Canadian Corporations/Holding Companies: What They Are and How They Work

Investment grade life insurance is the best passive investment vehicle available for Canadians to use inside corporations and holding companies. The main reason? It’s tax-exempt.

But first, let’s back up and look at other passive investments. The growth on passive investments in Canadian Corporations and Holding Companies such as stocks, bonds, mutual funds, ETFs and real estate are taxed at 50% in Ontario.

By comparison, money inside life insurance grows tax-free whether it is owned personally or owned by Corporations and Holding Companies.

Tax efficiency is why life insurance generally performs better than most other asset classes. In order for a Canadian entrepreneur to outperform life insurance in a 50% tax environment, they would need to take large investment risks. Oftentimes, taking that amount of risk can result in negative returns in any particular year. It’s an easy way for an investor to lose his shirt.

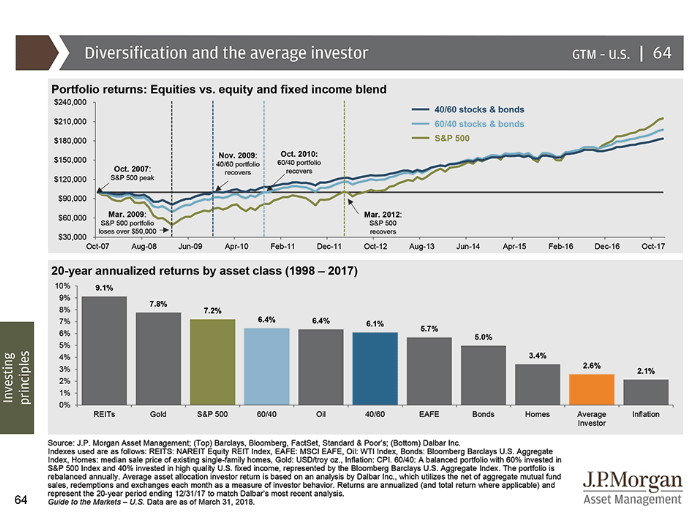

Let’s look at the real facts and numbers. Here’s a quick breakdown, over the last 20 years, of the performance of the main asset classes familiar to Canadian investors:

One particular thing highlighted in the chart is the annualized rate of return of average investors being at 2.6%. This is mainly attributed to “emotional investing”, meaning that most investors buy high (when the market is doing well) and sell low (when the market is in a correction).

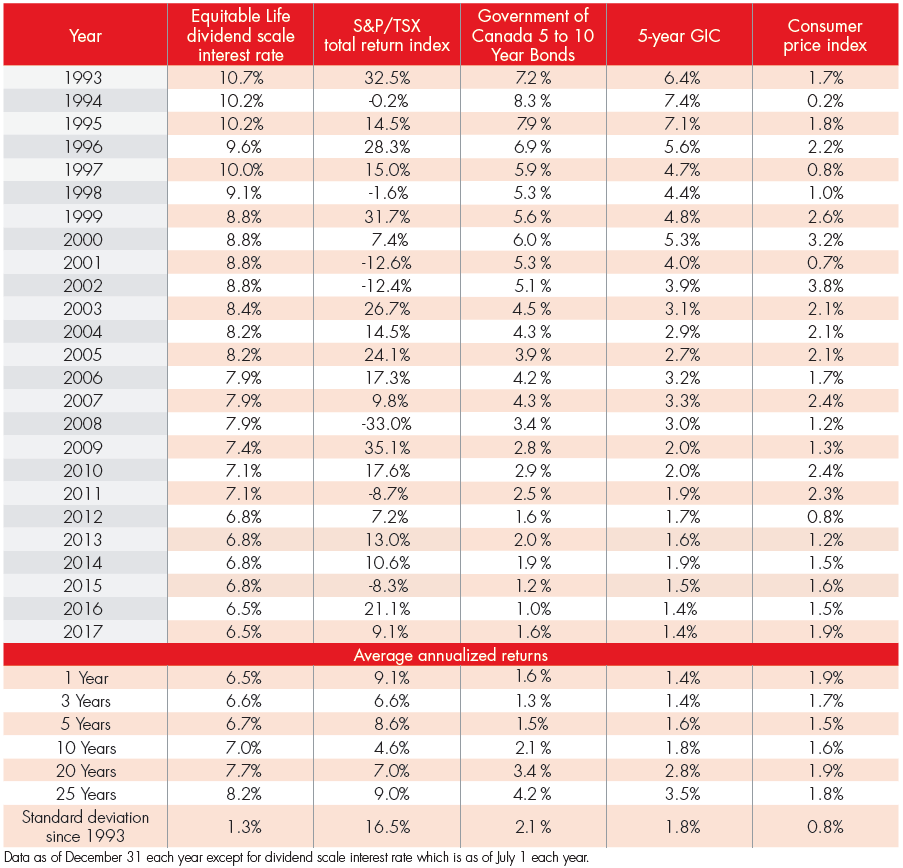

Now, for an idea of how whole life insurance generally compares, let’s take a look at Equitable Life’s whole life dividend scale (one of the best whole life contracts in Canada):

The numbers don’t lie. Whole life insurance has outperformed most investment types in the last 20-25 years. As a matter of fact, whole life insurance has had an average rate of return of about 9% per year in the last 60 years.

The numbers don’t lie. Whole life insurance has outperformed most investment types in the last 20-25 years. As a matter of fact, whole life insurance has had an average rate of return of about 9% per year in the last 60 years.

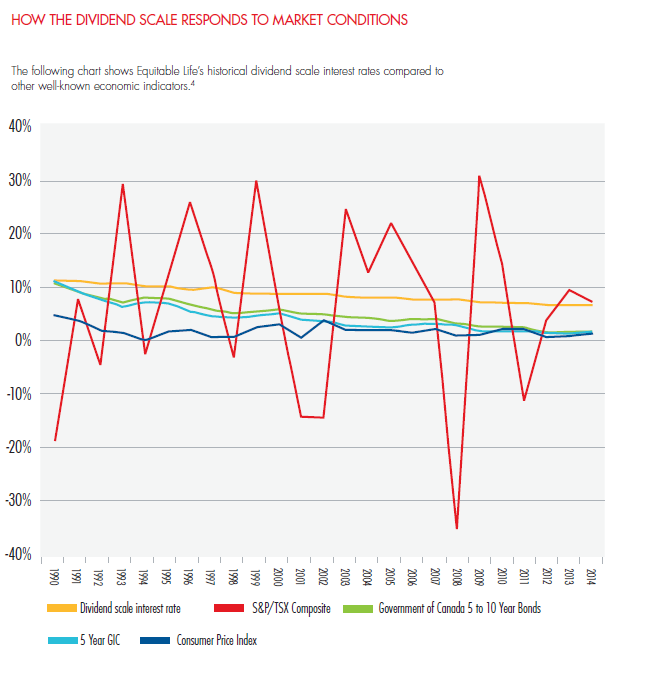

But there’s more to it. Whole life insurance as an investment also prevents investors from making major emotional mistakes. When stock markets are collapsing, typical investors fear losing all their money and when markets are performing extremely well, investors have a fear of missing out on great rates of return.

This general behaviour leads investors to buy high and sell low. A big advantage with whole life insurance is that it offers consistent rates of return on an annual basis. Once the cash value and death benefit of your insurance is at a specific value, it will not go down. The cash value and death benefit will keep going up and up each year.

How Life Insurance Works Inside Corporations/Holding Companies

The major advantage that life insurance has over other assets is it tax-haven status. Life insurance in Canada is the only tax shelter available for passive investments inside corporations or holding companies that are normally taxed at 50%. If you add the 50% passive investments tax on other asset types, it is clear that whole life insurance is the best performing after-tax asset class in Canada in the last 20-25 years.

Additionally, whole life insurance is much less volatile than other asset classes. Canadian life insurance companies have offered whole life insurance for over 100 years and they have paid dividends each and every year. Whole life insurance has gone through two world wars, the great depression, the tech bubble crash in the early 2000s, and the financial market crash of 2008 without seeing a negative rate of return.

Many Canadians think that life insurance isn’t a great investment vehicle because they believe the cash invested inside of life insurance will be used by their beneficiaries rather than used as retirement income.

However, that is entirely false. The cash value inside life insurance can be utilized to supplement retirement income on a tax-preferred basis.

Now, I’m certainly not saying that you should invest all your holding company assets inside life insurance. However, I’ve seen incorporated business owners experience a lot of success in the past when including whole life insurance as an asset class in their portfolio.

If you’re interested in learning more about how you can help grow and protect your wealth tax-free, book a complimentary one-on-one online meeting with me today. As your Certified Financial Planner, I’ll gather quotes from independent life insurance companies to find the best value for your specific situation (it can often be a six-figure difference or more). Then, we’ll work together to put your wealth to work for you.