Highlights of the 2020 Federal Fall Economic Statement | Additional $20,000 CEBA loan available now

On November 30, Finance Minister Chrystia Freeland provided the government’s fall economic update. The fall economic update provided information on the government’s strategy both for dealing with the COVID-19 pandemic and its plan to help shape the recovery. We’ve summarized the highlights for you.

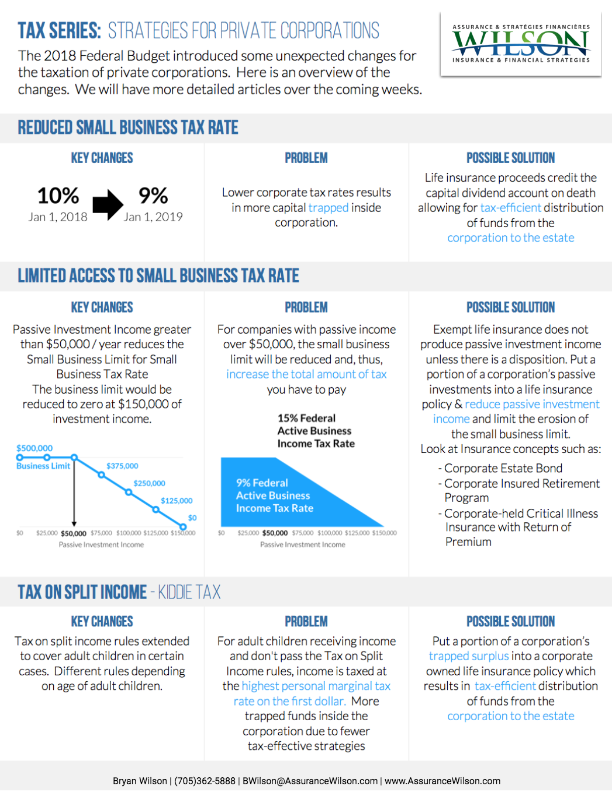

Corporate Tax Changes

Information on several subsidy programs was included in the update. These changes apply from December 20, 2020 to March 13, 2021.

-

The government has provided an increase in the Canada Emergency Wage Subsidy (CEWS) to a maximum of 75% of eligible wages.

-

If you are eligible for the Canada Emergency Rent Subsidy (eligibility is based on your revenue decline), you can claim up to 65% of qualified expenses.

-

The Lockdown Support Subsidy has also been extended – if you are eligible, you can receive a 25% subsidy on eligible expenses.

Also, there were two other significant corporate tax changes:

-

Starting January 1, 2022, the government plans to tax international corporations that provide digital services in Canada if no international consensus on appropriate taxation has been reached.

-

The tax deferral on eligible shares paid by a qualifying agricultural cooperative to its members has been extended to 2026.

Personal Tax Changes

The following personal tax changes were included in the update:

-

The update confirmed the government’s plan to impose a $200,000 limit (based on fair market value) on taxing employee stock options granted after June 2021 at a preferential rate. Canadian-controlled private corporations (CCPCs) are not subject to these rules.

-

If you started working from home due to COVID-19, you could claim up to $400 in expenses.

-

The Canada Child Benefit (CCB) has temporarily been increased to include four additional payments. Depending on your income, you could receive up to $1200.

-

Additional modifications were proposed to how the “assistance holdback” amount is calculated for Registered Disability Savings Plans (RDSP). The goal of these modifications is to help RDSP beneficiaries who become ineligible for the Disability Tax Credit after 50 years of age.

Indirect Tax Changes

GST/HST changes impacting digital platforms were included in the update. They will be applicable as of July 1, 2021:

-

Foreign-based companies that sell digital products or services in Canada must collect and remit GST or HST on their taxable sales. Also, foreign vendors or digital platform operators with goods for sale via Canadian fulfillment warehouses must collect and remit GST/HST.

-

Short-term rental accommodation booked via a digital platform must charge GST/HST on their booking. The GST/HST rate will be based on the province or territory where the short-term accommodation is located.

And some good news on a GST/HST removal! As of December 6, and until further notice, the government will not charge GST/HST on eligible face masks and face shields.

The Takeaway

A lot of changes came out of the fall update – and you may be feeling overwhelmed. But help is at hand!

Contact us to learn more about how these changes could impact your personal and business finances.

Canada Emergency Business Account (CEBA) $20,000 expansion available now

The Government of Canada website has been updated with the new CEBA requirements and deadlines:

-

As of December 4, 2020, CEBA loans for eligible businesses will increase from $40,000 to $60,000.

-

Applicants who have received the $40,000 CEBA loan may apply for the $20,000 expansion, which provides eligible businesses with an additional $20,000 in financing.

-

All applicants have until March 31, 2021, to apply for $60,000 CEBA loan or the $20,000 expansion.

Apply online at the financial institution your business banks with:

-

TD: https://www.td.com/ca/en/personal-banking/covid-19/small-business-relief/

-

BMO: https://www.bmo.com/small-business/financial-relief-loc/#/login?PID=MBLBC&language=en

-

National Bank: https://www.nbc.ca/forms/business/covid-emergency-account.html

-

Canadian Western Bank: https://www.cwbank.com/en/news/2020/canada-emergency-business-account-now-available (via phone/email)

To get the full details: